freddybrient2

About freddybrient2

Patriot Gold Group IRA: A Comprehensive Case Study

In the ever-evolving landscape of investment opportunities, gold has consistently emerged as a reliable asset, particularly during times of economic uncertainty. The Patriot Gold Group, a prominent player in the gold investment sector, offers Individual Retirement Accounts (IRAs) that allow investors to include physical gold and other precious metals in their retirement portfolios. This case study delves into the offerings, benefits, and overall impact of the Patriot Gold Group IRA on investors looking to diversify their retirement savings.

Background of Patriot Gold Group

Founded in 2016, the Patriot Gold Group has quickly established itself as a reputable company within the gold investment market. With a mission to provide investors with a secure and reliable way to invest in precious metals, the company has garnered a loyal customer base. The firm is known for its commitment to transparency, customer education, and a personalized approach to investment.

Understanding the Patriot Gold Group IRA

The Patriot Gold Group IRA is designed to facilitate investments in physical gold and other approved precious metals within a tax-advantaged retirement account. This type of IRA allows individuals to diversify their retirement savings beyond traditional stocks and bonds, providing a hedge against inflation and economic downturns.

Types of Precious Metals Offered

Investors can include various types of precious metals in their Patriot Gold Group IRA, including:

- Gold: Coins and bullion bars, including American Gold Eagles, Canadian Gold Maple Leafs, and more.

- Silver: Options such as American Silver Eagles and Canadian Silver Maple Leafs.

- Platinum and Palladium: Both metals are also available for inclusion in the IRA, offering further diversification.

Benefits of Investing in a Patriot Gold Group IRA

- Diversification: One of the primary benefits of a Patriot Gold Group IRA is the ability to diversify retirement portfolios. By including physical gold and other precious metals, investors can mitigate risks associated with stock market volatility.

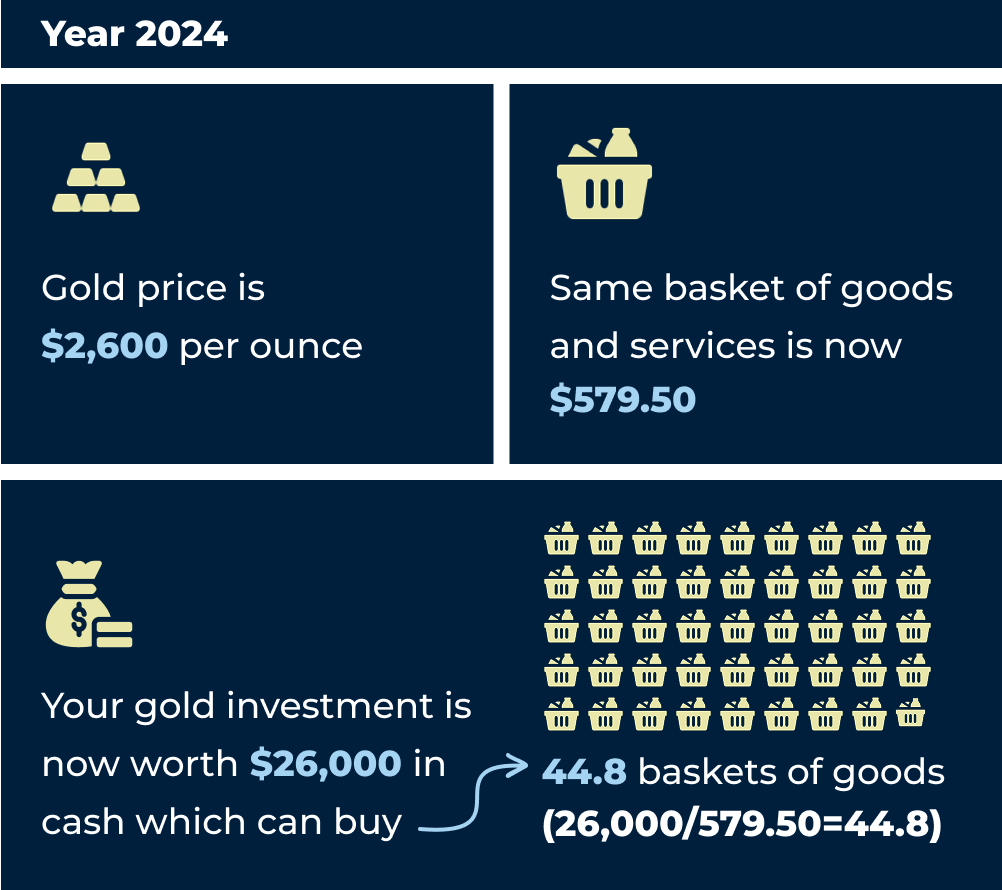

- Protection Against Inflation: Historically, gold has been seen as a hedge against inflation. As the value of currency declines, the price of gold often rises, making it a valuable asset during inflationary periods.

- Tax Advantages: Investing in a gold IRA allows individuals to enjoy tax-deferred growth on their investments. This means that investors do not pay taxes on any gains until they withdraw funds from the account, typically during retirement.

- Tangible Asset: Unlike stocks and bonds, physical gold is a tangible asset that investors can hold. This can provide peace of mind, particularly during economic uncertainty.

- Customer Support and Education: The Patriot Gold Group prides itself on offering exceptional customer service. They provide educational resources and personalized assistance to help investors make informed decisions about their retirement savings.

The Process of Setting Up a Patriot Gold Group IRA

Setting up a Patriot Gold Group IRA involves several steps:

- Consultation: Potential investors begin with a consultation to discuss their goals, investment strategies, and the types of metals they wish to include in their IRA.

- Account Setup: Once the investor decides to proceed, the Patriot Gold Group assists in setting up a self-directed IRA with a custodian that specializes in precious metals.

- Funding the Account: Investors can fund their IRA through various means, including rollovers from existing retirement accounts or direct contributions.

- Purchasing Precious Metals: After the account is funded, investors can select the specific precious metals they wish to purchase. The Patriot Gold Group facilitates these transactions, ensuring compliance with IRS regulations.

- Storage: The physical metals purchased are stored in a secure, IRS-approved depository. This ensures that the assets are protected and compliant with regulatory requirements.

Case Study: A Real Investor Experience

To illustrate the impact of the Patriot Gold Group IRA, we can examine the experience of an investor, John Doe, a 45-year-old financial analyst from Texas. Concerned about market volatility and the potential for inflation, John sought to diversify his retirement savings.

After researching various options, John contacted the Patriot Gold Group for a consultation. He was impressed by the company’s commitment to customer education and transparency. During his consultation, John learned about the benefits of including physical gold in his IRA and decided to move forward.

John set up a self-directed IRA and rolled over a portion of his existing 401(k) into the new account. He chose to invest in American Gold Eagles and Canadian Gold Maple Leafs, valuing both their liquidity and historical performance. With the assistance of the Patriot Gold Group, John completed his purchases and arranged for secure storage of his metals.

Over the next several years, John monitored the performance of his gold investments. If you have any issues with regards to the place and how to use this hyperlink, you can contact us at our web site. As market conditions fluctuated, he found comfort in knowing that his investment in precious metals provided a buffer against economic uncertainty. When the stock market experienced a downturn, John’s gold holdings appreciated, ultimately contributing positively to his overall retirement portfolio.

Conclusion

The Patriot Gold Group IRA presents a compelling option for investors seeking to diversify their retirement savings with physical gold and other precious metals. Through its commitment to customer education, personalized service, and a transparent investment process, the company has positioned itself as a leader in the gold investment market.

As economic conditions continue to fluctuate, the importance of diversifying retirement portfolios with tangible assets like gold becomes increasingly evident. The case of John Doe exemplifies how a Patriot Gold Group IRA can serve as a strategic tool for investors looking to safeguard their financial future while capitalizing on the inherent value of precious metals. With the right guidance and resources, investors can navigate the complexities of retirement planning and create a resilient portfolio that withstands the test of time.

No listing found.